does texas have inheritance tax 2021

Heres why it starts so late. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

State Death Tax Hikes Loom Where Not To Die In 2021

In August Mayor Muriel Bowser signed the Estate Tax Adjustment Act.

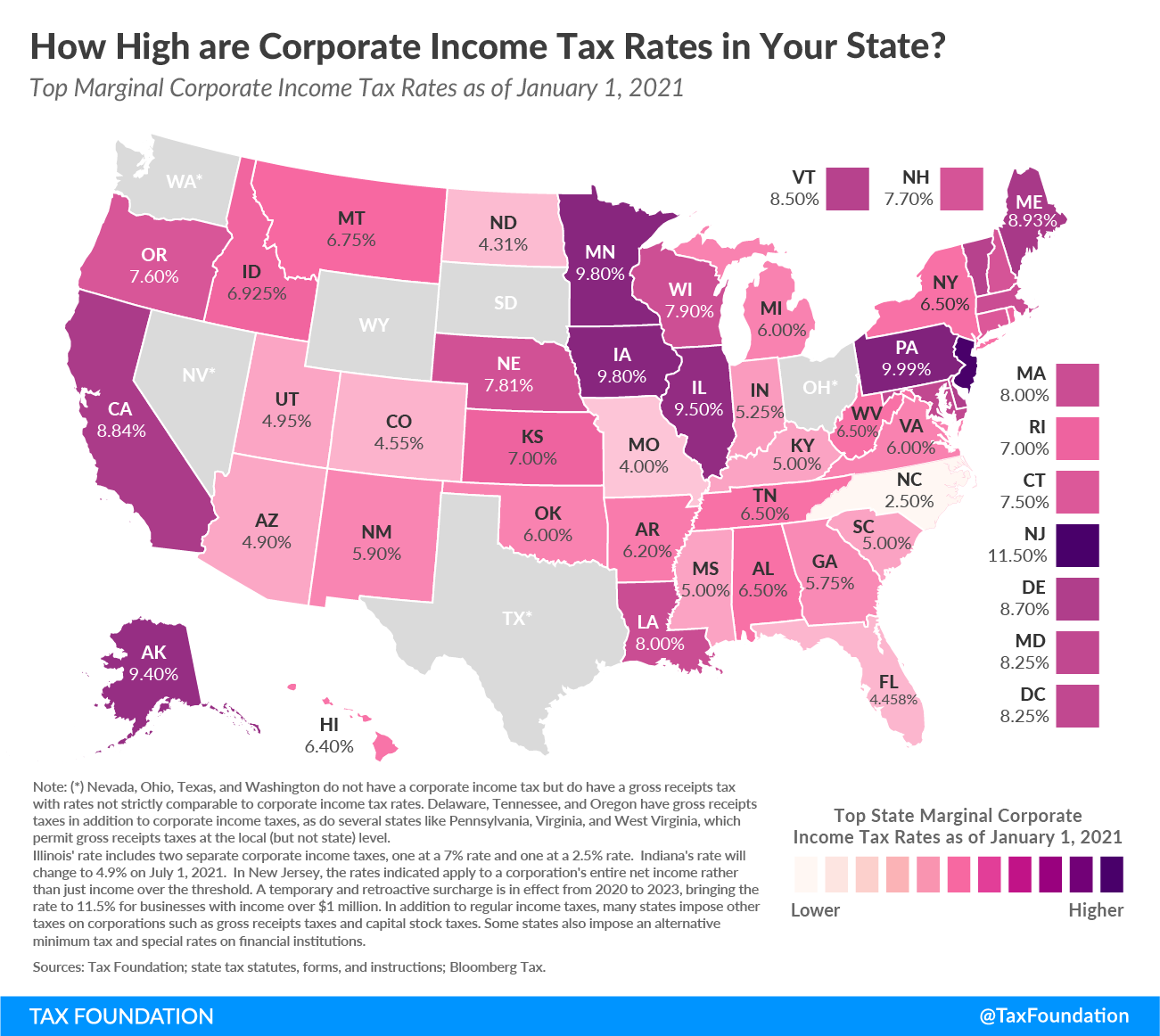

. However this is only levied against estates worth more than 117 million. Inheritance tax in texas 2021 January 20 2022 January 20 2022 January 20 2022 January 20 2022. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses.

Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. As of 2019 only twelve states collect an inheritance tax. These states have an inheritance tax.

As of 2021 the federal estate tax only kicks in once the deceaseds estate is valued at above 117. Most people dont have to deal with inheritance tax but those with. Your 2020 tax returns.

Texas does not have a state estate tax or inheritance tax. Estate tax applies at the federal level but very few people actually have to pay it. The tax rate varies.

However it does have an estate tax. There is no federal inheritance tax and only six states have a state-level tax. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

MoreIRS tax season 2021 officially kicks off Feb. Texas Inheritance Tax and Gift. The state of Texas is not one of these states.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. There is no federal inheritance tax but there is a federal estate tax. Texas repealed its inheritance tax law in 2015 but other.

The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. In 2022 there is an. The big question is if there are estate taxes or.

In 2022 Connecticut estate taxes will range from 116 to 12. The state repealed the inheritance tax beginning on Sept. Iowa Kentucky Maryland Nebraska New Jersey.

The federal government of the United States does have an estate tax. Probate is the process of recognizing a persons death and closing up their estate. The estate is everything the person owned at the time of death.

Moreover the tax is paid by the beneficiary after the assets have. For 2021 the IRS estate tax exemption is 117 million per individual which means that a. The tax rate varies.

New York raised its exemption level to 525 million. What states have inheritance taxes 2021. For 2021 the IRS estate tax exemption is 117 million per individual which means that a person could leave 117 million.

The federal estate tax goes into effect for estates valued at 117 million and up in 2021 for singles. An inheritance tax on the other hand is a tax imposed only on the value of assets inherited from an estate by a beneficiary. Already the District of Columbia has toughened its estate tax levy effective January 1 2021.

As of 2022 if an individual leaves less than 1206 million to their heirs they wont have to worry about paying any federal estate tax in the US. The Texas Franchise Tax. The Tax Foundation Feb.

Probate Laws in Texas. As noted only the wealthiest estates are subject to this tax. Does Texas Have an Inheritance Tax or Estate Tax.

Gift Taxes In Texas. In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Anything over these amounts will be taxed at a rate of 40. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government.

Married couples can shield up to 2412 million together tax-free. However Texas residents still must adhere to federal estate tax guidelines. So only very large.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Texas Estate Tax Everything You Need To Know Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

Do I Have To Pay Taxes When I Inherit Money

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Estate Tax Everything You Need To Know Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

Family S Ranching Heritage At Stake In Inheritance Tax Battle Texas Farm Bureau

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Texas Inheritance And Estate Taxes Ibekwe Law

How Do State And Local Individual Income Taxes Work Tax Policy Center

Texas Estate Tax Everything You Need To Know Smartasset

Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Texas State Taxes Forbes Advisor

Taxes Archives Skloff Financial Group

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

States With No Estate Tax Or Inheritance Tax Plan Where You Die