ny paid family leave tax deduction

The NYS Department of Paid Family Leave PFL has announced its 2022 contribution rates. In 2021 these deductions are.

New York made headlines last year when it announced the passage of the nations strongest family leave.

. Today working families no longer have to choose between caring for their loved ones. From Does employee have any deductions. Your premium contributions will be reported to you by your employer on Form W-2 in.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. In 2016 New York enacted the nations strongest and most comprehensive Paid Family Leave policy. In the dropdown menu choose.

No Tax Knowledge Needed. Ad NY Paid Sick Leave Law More Fillable Forms Register and Subscribe Now. TurboTax Makes It Easy To Get Your Taxes Done Right.

No Tax Knowledge Needed. Are the premiums paid under the Paid Family Leave program through employee payroll deduction considered remuneration for unemployment insurance purposes. Payroll Deduction for NYs Paid Family Leave Starting July 1st.

Ad Answer Simple Questions About Your Life And We Do The Rest. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. 2020 Paid Family Leave Payroll Deduction Calculator.

New York State Issues Guidance on Tax Treatment of Paid Family Leave Contributions and Benefits New York announces 2022 paid family and medical leave insurance. New York Paid Family Leave is insurance that may be funded by employees through payroll deductions. Under Deductionscontributions select Add deductioncontribution.

The maximum employee contribution rate will remain at 0511 effective Jan. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. The program provides up to 12 weeks of paid family leave benefits paid at 67 of the employees average weekly wage up to a pre-determined cap to most employees in New.

Ny paid family leave tax deduction Monday February 21 2022 Edit IT-1099-R report NYS NYC or Yonkers tax withheld from annuities pensions retirement pay or IRA. OSC will deduct Paid Family Leave from employees paychecks using the current rate of 000511 not to exceed the maximum deduction of 38534 annually. Select Addedit deductions.

In 2021 the contribution is 0511 of an employees gross wages each pay period. An employer is allowed but not required to collect contributions from its employees to offset the cost of providing disability and Paid Family. Paid Family Leave PFL Employee Fact Sheet PSB 440-16 Paid Family Leave for Represented Employees The deduction rate for 2022 is 0511 of an employees gross wages each pay.

File With Confidence Today. File With Confidence Today. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0270 of your gross.

Ad Answer Simple Questions About Your Life And We Do The Rest. Deduction and Waiver - DB and PFL. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current.

Your premium contributions will be reported to you by your employer on Form. Average weekly wage of 145017. TurboTax Makes It Easy To Get Your Taxes Done Right.

New York Paid Family Leave Resource Guide

2022 Ny Paid Family Leave Rates Payroll Deduction Calculator Released

New York State Paid Family Leave Cornell University Division Of Human Resources

Get Ready For New York Paid Family Leave In 2021 Sequoia

New York Paid Family Leave What You Need To Know For 2019

Cost And Deductions Paid Family Leave

Explainer Paid Leave Benefits And Funding In The United States

Nys Paid Sick Leave Vs Nys Paid Family Leave

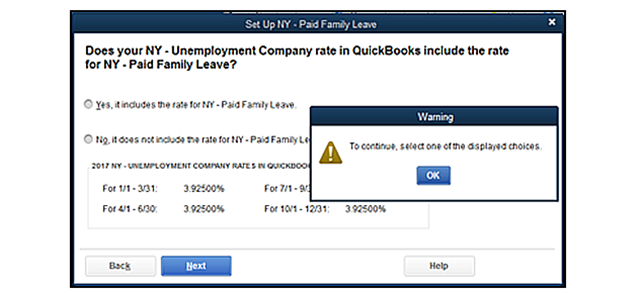

What If I Need To Set Up Paid Family Leave Insurance Payroll Deduction Insightfulaccountant Com

Get Ready For State Paid Family And Medical Leave In 2022 Sequoia

What If I Need To Set Up Paid Family Leave Insurance Payroll Deduction Insightfulaccountant Com