st louis county personal property tax receipt

Charles County Collector of Revenue 201 N Second St Suite 134 Saint Charles MO 63301 and the. Search by Account Number or Address.

Waiting On Your Tax Bill St Louis County Says Printing Issue Delayed Mailing Vendor Says County Sent Files Late Politics Stltoday Com

8am 430pm M F.

. Paying Property Taxes with Debit Cards or Credit Cards All payments are processed through Official Payments Corp. Louis real estate tax payment history print a tax receipt andor proceed to payment. Personal property tax waivers Personal property accountstax bill.

The Jackson County Courthouse is located at. Obtaining a property tax receipt. How do I find out who owns a property in St Louis County.

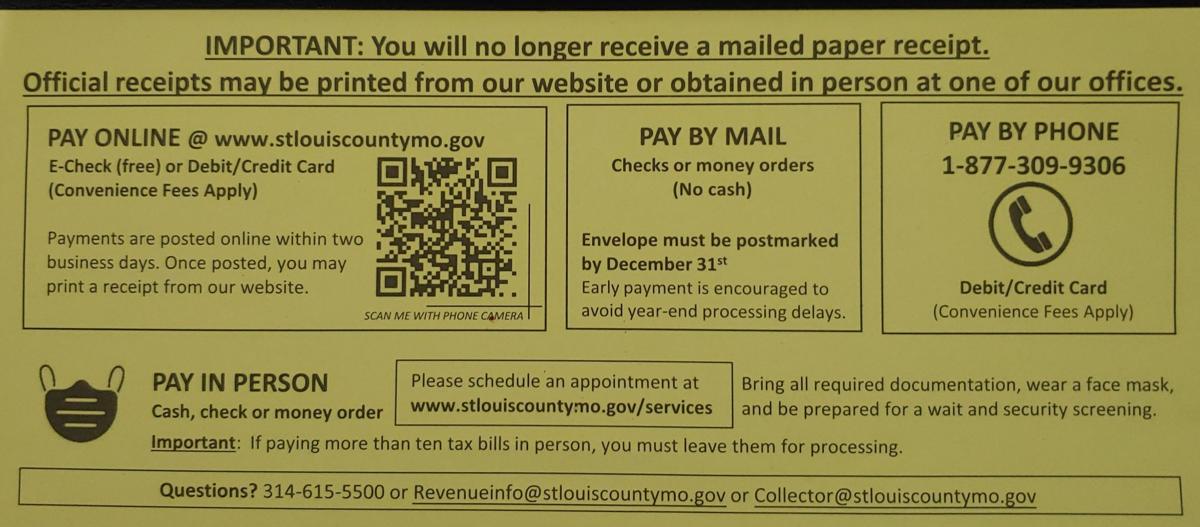

These tax bills are mailed to citizens in November and taxes are due by December 31st of each year. Louis MO 63129 Check cash money order Check cash money order M F. Louis County please complete the New Resident Personal Property Declaration form.

201 N Second St Suite 134. The value of your personal property is assessed by the Assessors Office. The median property tax in St.

You may file a Small Claims case in the St. Personal Property Tax Department. To 5 pm Monday through Friday excluding holidays observed by Jackson County.

You can also obtain a receipt for 100 at one of our offices. Personal property tax receipts are available online or in person. Visit the Address Property Search page.

To declare your personal property declare online by April 1st or download the printable forms. Obtain a Real Estate Tax Receipt Instructions for how to find City of St. If you did not file a Personal Property Declaration with your local assessor.

Ann MO 63074 Keller Plaza 4546 Lemay Ferry Rd. Leave this field blank. 1200 Market Street City Hall Room 109.

Personal property account numbers begin with the letter I like in Individual followed by numbers. Property Tax Receipts are obtained from the county Collector or City Collector if you live in St. Mail a request stating the account numbers and tax years for which Duplicate Receipts isare requested along with a check or money order for the total number of receipts requested times the 1 statutory fee to.

The Personal Property Department collects taxes on all motorized vehicles boats recreational vehicles motorcycles and business property. Payments made directly on our website post within two business days but we cannot provide a posting time estimate for mailed payments. Both courthouses are open 8 am.

For information call 314-615-8091. Enter the propertys address or parcel ID. All 2020 and prior Real Estate taxes must be paid in full to prevent their.

Contact the Collector - Real Estate Tax Department. Personal property tax is collected by the Collector of Revenue each year on tangible property. The Assessor together with his team of professional appraisers analysts and managers is required by Missouri law to calculate the market value of real property and business personal property.

About the Personal Property Tax. If you are a new Missouri resident or this is your first time filing a declaration in St. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov.

8am 430pm Services Offered. When you click on the logo for your payment type you will be directed to the Parcel Tax Lookup screen. 636-797-5466 Personal Property Questions.

We no longer mail receipts but you will be able to print an official receipt from our website after your payment has posted. County Assessor Administration Center LL17 lower level 729 Maple Street Hillsboro Missouri 63050 Real Estate Questions. 112 W Lexington Suite 114 Independence MO 64050.

Louis County has one of the highest median property taxes in the United States and is ranked 348th of the 3143. Assessments are due March 1. If you opt to visit in person please schedule an appointment.

Louis County has been mailing out yellow slips stating the change with real estate and personal property tax bills. The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes. 415 E 12th Street Suite 100 Kansas City MO 64106.

Charles County as of the tax dateThis assures the tax burden is distributed fairly among those. Your feedback was not sent. If you do not receive a form by mid-February please contact Personal Property at.

Saint Charles MO 63301-2889. Louis County Missouri is 2238 per year for a home worth the median value of 179300. Louis County Circuit Court 7900 Carondelet in Clayton Monday through Friday 800 am to 500 pm.

City Hall Room 109. Your tax bill is comprised of three key components. Monday May 02 2022 Welcome.

Louis City in which the property is located and taxes paid. Personal property taxes for your car motorcycle trailer etc. The assessment authority Assessors Office is responsible for establishing the fair market value of all property within St.

County-wide reassessments take place every two years in odd numbered years. November through December 31st you may also drop off your payment in the night deposit box at one of four Commerce Bank locations. View the owner information under Basic Info How do I get a copy of my personal property tax receipt in Missouri.

The Historic Truman Courthouse is located at. While property values listed on the assessment. Duties of the Assessor.

For a pamphlet with information on Small Claims Court call 314-615-2601 or 314-615-2592. If you are paying prior year taxes you must call 218 726-2383 for a payoff amount. Louis County collects on average 125 of a propertys assessed fair market value as property tax.

Monday - Friday 800am - 500pm. Obtain a Tax Waiver Statement of Non-Assessment Residents with no personal property tax assessed in the prior year can obtain a statement of non-assessment tax-waiver. E-File Your 2022 Personal Property Assessment.

2022 Individual Personal Property Declarations are in the mail and are due by June 30th 2022. Monday - Friday 800am - 500pm. Accounts must be paid in full to get the Personal Property Tax Receipt needed for Vehicle Registration Renewals.

Use your account number and access code located on your assessment form and follow the prompts. Your feedback was not sent. You may click on this collectors link to access their contact information.

Personal Property Declaration St Louis County Fill And Sign Printable Template Online Us Legal Forms

Look For Property Tax Bills In Mail You Can Avoid Lines By Paying Online St Louis Call Newspapers

St Louis County Explains Delays In Mailing Personal Property Tax Ksdk Com

Collector Of Revenue St Louis County Website

Collector Of Revenue St Louis County Website

St Louis County No Longer Mailing Personal Property Real Estate Tax Receipt Unless Requested Youtube

St Louis County Property Tax Deadline

Online Payments And Forms St Louis County Website

Filing Your St Louis County Personal Property Tax Declaration Robergtaxsolutions Com

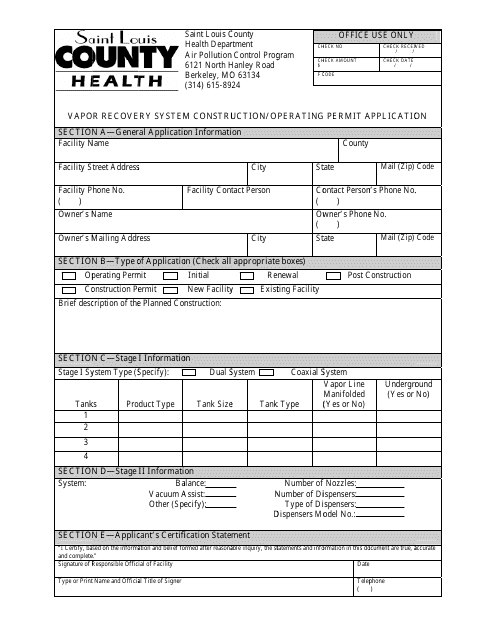

Saint Louis County Missouri Vapor Recovery System Construction Operating Permit Application Download Printable Pdf Templateroller

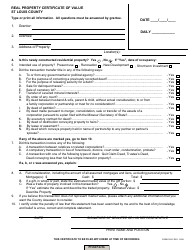

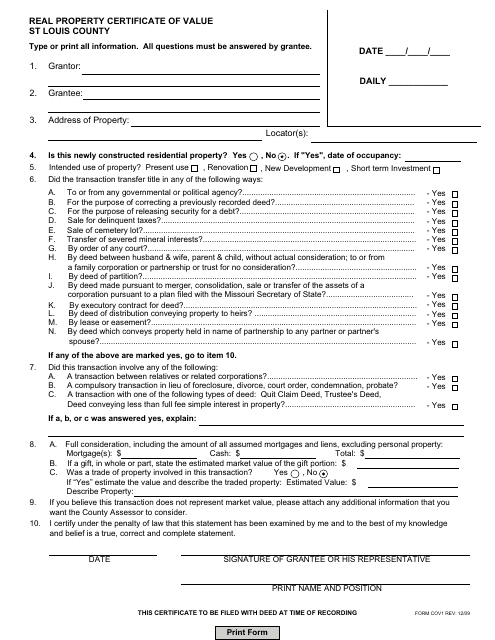

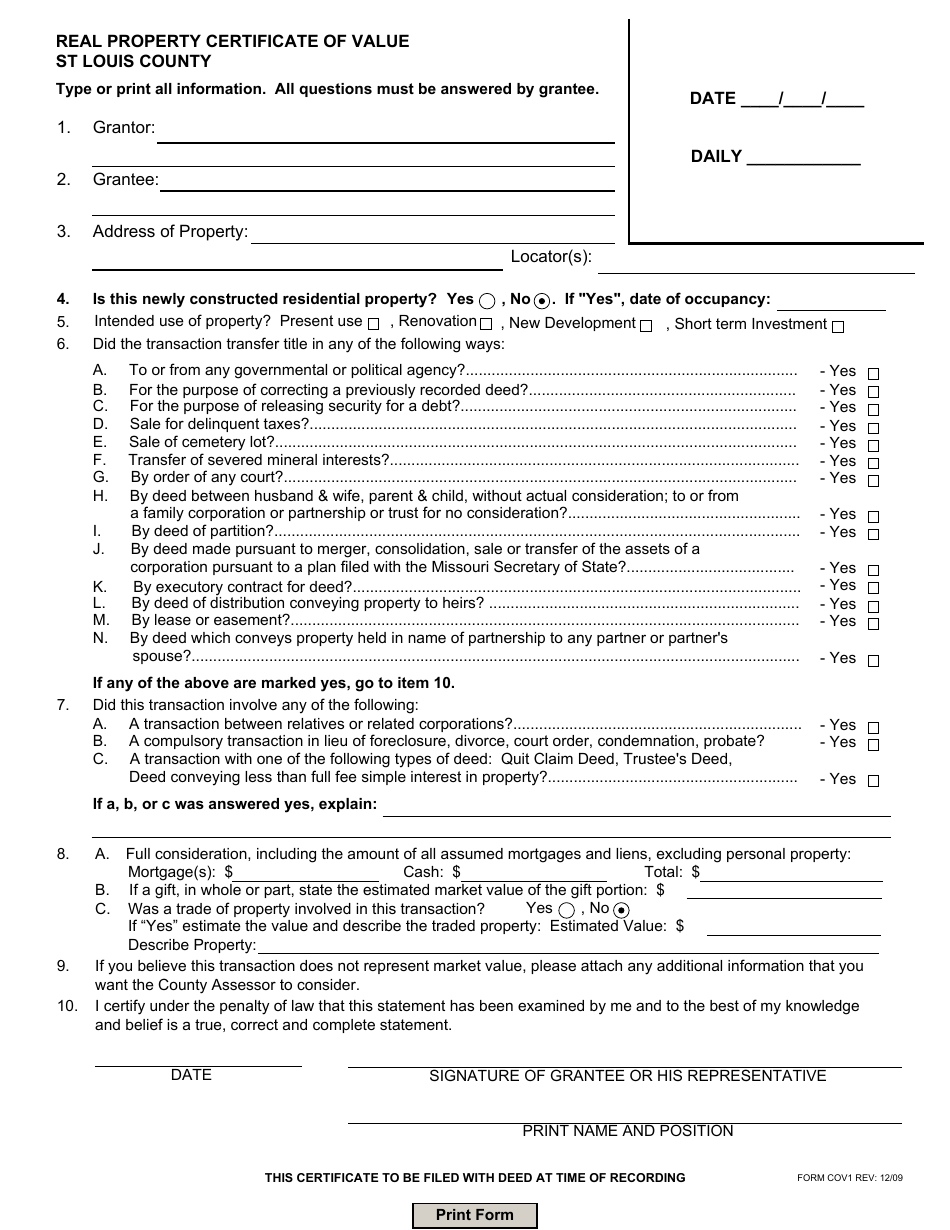

Form Cov1 Download Fillable Pdf Or Fill Online Real Property Certificate Of Value St Louis County Missouri Templateroller

Form Cov1 Download Fillable Pdf Or Fill Online Real Property Certificate Of Value St Louis County Missouri Templateroller

St Louis County Directs Residents To Go Online For Property Tax Receipts Politics Stltoday Com

Form Cov1 Download Fillable Pdf Or Fill Online Real Property Certificate Of Value St Louis County Missouri Templateroller